On Tuesday (August 9th), the global market was “a sudden changeâ€, the US dollar index fell to the 96 mark, and the GBP/USD fell below the 1.30 mark to a one-month low. As the dollar fell from a high level, the gold bulls made a comeback and broke through the $1,340/oz barrier. The trend of crude oil is exactly the opposite. The US market retreated all the gains and then declined. The market expects that OPEC will repeat the same mistakes and will not reach a frozen production agreement. Jon Hilsenrath, a reporter for the "Fed News Agency", said that the weaker dollar this year is conducive to inflation and economic growth, and the Fed is more likely to put interest rates on the agenda.

The dollar and crude oil are "high in the cold". Gold and the stock market are "smileing"

In the European market on Tuesday, the US dollar index oscillated downwards, hitting a low of 96.09 in the day, breaking the 96 mark, mainly dragged down by the bullish profit. In addition, last week's strong non-agricultural data rekindled the Fed's interest rate hike expectations, but there are still uncertainties at present, especially the election is approaching.

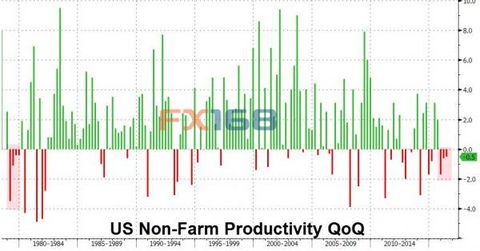

The data released during the day is still uneven. The US Department of Labor announced on Tuesday that the initial value of non-agricultural productivity fell for the third consecutive quarter in the second quarter, indicating that US labor productivity is still stalling.

The data shows that the second quarter non-agricultural productivity was down 0.5% from the initial rate, which is estimated to increase by 0.4%. The first quarter was down by 0.6%, and the previous value was down by 0.6%. The rate of decline in productivity was the highest since 1993.

(Non-agricultural productivity chart source: Zerohod, FX168 financial network)

The Wall Street Journal reported that US non-agricultural productivity recorded a decline for three consecutive quarters, the first time since 1979.

Bank of America Merrill Lynch analyst Michelle Meyer said in the report: "With the potential economic growth decline, the equilibrium interest rate is reduced. In the case of an inflation target of 2%, the Fed will set the equilibrium real federal funds rate R* to 1 %, short-term interest rates are close to zero. The pressure on productivity growth means that policy rates will be lower than what monetary policymakers believe will be reached in the long run."

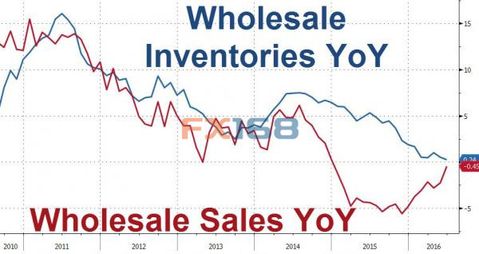

However, due to the growth of agricultural products 000061, stock bars and other non-durable goods stocks, US wholesale inventories unexpectedly increased in June, indicating that the initial valuation of economic growth in the second quarter may be revised.

The US Commerce Department announced on Tuesday that US wholesale inventories rose by 0.3% in June from the previous month, and the estimate was flat. In May, it was revised up to 0.2%, and the previous value was 0.1%.

(Source: Zerohedge, FX168 Financial Network)

The data also showed that the monthly rate of wholesale sales in the United States rose by 1.9% in June. The US June inventory/sales ratio was 1.33 months, and May was 1.35 months.

Reuters commented that the current round of data unexpectedly increased, mainly due to the increase in the inventory of agricultural products and other non-durable goods, the wholesale inventory in addition to automobiles in GDP statistics increased by 0.3% in June, indicating that the US second quarter GDP growth rate may be Repaired.

For most of the day, the US dollar traded against a basket of currencies near the flat, hitting a low of 1.1121 against the euro and 101.79 against the yen. The pound plunged 0.6% against the dollar to a one-month low.

(US refers to the 60-minute chart source: Zerohorge, FX168 financial network)

"We won't see gold reacting to this. This is worth paying attention to, but it won't trigger a sell-off," Cardillo of First Standard pointed out.

According to Jon Hilsenrath, a reporter for The Wall Street Journal, known as the Fed News Agency, the dollar has fallen about 4% against a basket of currencies this year, even after the Bank of England cut interest rates last week and the US non-agricultural data was strong. The dollar is only slightly up. A weaker dollar is good for inflation and economic growth, which will make it easier for the Fed to raise interest rates. Hilsenrath said that the recent US dollar trend will make it easier for the Fed to raise interest rates later this year. If officials think that the economic background is suitable for raising interest rates, they may take action.

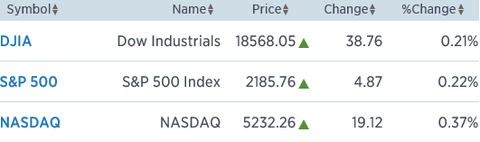

European and American stock markets are all red. The pan-European 300 index closed up 0.97% at 1358.10 points on Tuesday; the UK FTSE 100 index closed up 0.6%; the French CAC 40 index closed up 1.2%;

The German DAX 30 index closed up 2.6%, hitting its highest level so far this year. US stocks opened flat on Tuesday and then climbed quickly. In the early morning of the US market, the S&P 500 index broke through 2,185.44 points, and the second consecutive trading day set a new high in the intraday record. The Nasdaq also broke through 5231.942 points, marking the second consecutive trading day to refresh the intraday record high.

(Source: CNBC, FX168 Financial Network)

“This is August. There is not much news, and most of the company’s performance has already been released,†said Maris Ogg, president of Tower Bridge Advisors. “The difficulty in this market is valuation. It’s not expensive, but it’s not super cheap, so people are not excited. Then buy it."

Recently, the stock market traded in a narrow range. The CBOE Volatility Index (VIX, commonly known as the Panic Index) fell 2.78% at the beginning of the session, at 11.18, which was created after the August 5 non-farm payrolls report. The lowest since since.

After the US wholesale inventory data, the oil price retreated all the gains in the day and fell, the US oil fell below the $43/barrel mark, and the minimum oil hits $44.80/barrel.

(US oil 60 minutes chart source: FX168 financial network)

OPEC Chairman Mohammed Al Sada said on Monday that member states plan to meet next month to participate in the International Energy Forum and hold an informal meeting in Algeria. This news caused oil prices to soar by more than 3% on Monday.

“Crude oil prices have risen in the past, so OPEC may not reach an agreement,†said Kaname Gokon of Tokyo’s Okada Corporation. "Russia seems to be keeping a distance from OPEC."

Ashley Petersen, an analyst at Morgan Stanley, pointed out that despite the recent rebound in oil prices, oil prices are expected to fall further in the next 1-3 months, and the market futures premium will be widened. The next target for oil prices may look at $35/barrel. At the same time, if fundamentals deteriorate, such as Libya's supply returning to the market and macroeconomic worries, oil prices may fall to $30/barrel.

However, Tom Petrie, chairman of investment bank Petrie Partners, believes that oil prices may fall back and test $40 a barrel, but the decline is almost over.

In the intraday market, the short-term spot gold suddenly rose, recovering all the declines in the day, breaking through $1,340 per ounce, the highest level hitting the highest level of $1,342.10 per ounce since the two trading days.

(Spot gold 60 minutes chart source: FX168 financial network)

According to COMEX's most active December gold futures contract, the volume reached 3,271 lots in 21:24 Beijing time, and a large number of buy orders pushed up the spot gold price to approach the $1,340/oz mark.

Some market participants pointed out that the short-term price of gold was due to the fact that the first investor believed that the US election would still drag down the Fed’s rate hike process; the second last Friday, after the gold plunge, there was also a technical rebound demand.

"The price of gold was on the defensive after Friday's setback, reflecting the market's expectation of the Fed's interest rate hike in December," said National Bank of Australia (NAB) analyst Vyanne Lai. "But the price of gold will not be significantly weaker in the short term."

Kitco News said in a report released on Monday that gold had weakened on Monday after a sharp fall in gold due to strong non-agricultural power, but the upward trend in gold has not changed. The current correction is only for the next step. .

“The United States does not raise interest rates as fast as we expected, so the macroeconomic environment is still good for the gold market,†said Frank Nganou, mining analyst at Deutsche Bank. “It’s time to look at the central bank and whether they will keep the doves. The United States’ Affect the price of gold."

The eagle screams to scare the stupid sterling data and then "salt the salt on the wound"

Stuck by the Bank of England’s monetary policy commissioner McCafferty, the pound hit a one-month low on Tuesday. McCafferty said that if the UK economy accelerates, it may need more quantitative easing. McCafferty previously opposed the expansion of QE in the August interest rate decision.

In an article written for The Times, McCafferty wrote that interest rates could be further reduced, closer to zero, and that quantitative easing could be overweight. McCafferty also cautioned that information reflecting the extent of the UK's economic downturn is still limited.

GBP/USD fell 0.6% to 1.2956, the lowest since July 11. After the release of industrial production data in June, which was in line with expectations, the exchange rate rebounded slightly to 1.30. EUR/GBP rose 0.7% to £0.8566, also hitting a month high.

(Pound Sterling / US Dollar 60 Minute Chart Source: FX168 Financial Network)

The National Bureau of Statistics of the United Kingdom announced that the second quarter of the UK's industrial production recorded the largest increase since 1999; industrial production in June increased by 0.1% from the previous month, in line with analysts' expectations.

But what is not conducive to the pound is that the UK trade deficit soared in June, with imports of goods and services at 48.927 billion pounds, the highest record, and a record high import from the EU.

According to estimates by the National Institute of Economic and Social Research (NIESR) on Tuesday, the British economy began to shrink in July after the British referendum decided to withdraw from the European Union.

NIESR expects the UK economy to contract by about 0.2% in July, slowing the three-month growth rate to 0.3% in July, down from 0.6% in the three-month growth rate as of June.

Monthly economic data showed that the economic start in the third quarter was weak, and output fell in July,†said NIESR researcher James Warren.

"Our estimates suggest that the UK economy is about 50% less likely to experience a technical recession by the end of 2017," Warren said, reiterating NIESR's expectations for the UK's economic outlook last week, when NIESR cut its UK economy forecast this year and next.

“Industrial production data is in line with estimates, and the trade deficit is higher than expected,†said Tobias Davis, head of UK corporate bond sales at Western Union Bank, who said he expects the pound to remain under pressure in the short term.

BNP Paribas still maintains an overall bearish stance against the pound, and it is expected that the pound/dollar will fall to 1.24 in the near future. According to the BNP Paribas valuation model, it is recommended to short the GBP/USD and the target is towards 1.2677.

Some traders said that UK bond yields fell to record lows and also put pressure on the pound.

During the day, the UK 10-year bond yield and five-year yields both hit record lows after the Bank of England’s repurchase program failed – failing to get full supply. UK 20-year and 30-year Treasury yields also set a record low, falling more than 5 basis points so far this day, following the five-year and 10-year British debts to record lows.

Speculators have been selling pounds before the Bank of England meeting last week. The Bank of England cut interest rates to record lows at the meeting and announced quantitative easing measures to cushion the impact of the Brexit referendum on the economy.

Data released by the US Commodity Futures Trading Commission (CFTC) on Friday showed that speculators' short bets on the pound rose to a record high before the Bank of England held its meeting last week.

HSBC said that as the current account deficit continues to widen, the pound may fall further in the coming months. They expect the pound/dollar to hit 1.20 by the end of the year and fall to $1.10 by the end of 2017, when EUR/GBP is expected to hit parity.

(Editor: Wang Zhiqiang HF013)Rayon Printing,Reyon Print,Twill Woven Viscose Rayon Fabric,Rayon Single Twill Printed

Shaoxing Shangda Textile Co., Ltd , https://www.shangdatex.com