Affected by factors such as the expected rate hike by the Fed during the year, the US dollar index continued its downward trend on Wednesday (August 10) and weakened across the board. As the dollar fell, non-US currencies led by the euro and the pound, as well as precious metals such as gold and silver, were “carnival,†with platinum and palladium soaring more than 6% and 7%, respectively. The crude oil market once again encountered “Waterlooâ€. The EIA data released at night showed that US crude oil inventories increased by more than 1 million barrels last week, which was the third consecutive week of increase. The oil price was under pressure to expand to 2%. Bloomberg pointed out that the decline in refinery demand is the main reason for the unexpected increase in EIA crude oil inventories. The 2% drop in oil prices is not the end...

During the day, the US dollar index continued its downward trend, hitting a new low of 95.45 in a week, and has fully retreated in July after the non-agricultural gains.

(US dollar index 60 minutes map source: FX168 financial network)

“There is a broad trend in the market this week to sell dollars,†said Vassili Serebriakov, currency strategist at the French Agricultural Credit Bank in New York.

From a fundamental point of view, Monday's Job Market Condition Index (LMCI) will undoubtedly further boost the dollar since the unexpectedly strong non-agricultural data released last Friday, but not. Therefore, the negative dollar may be an economic report yesterday.

The US Department of Labor said that the second-quarter non-agricultural productivity unexpectedly fell in the second quarter, indicating that economic growth may not be as fast as expected, prompting investors to cut long-term inflation estimates.

"The second quarter of the US productivity decline for the third consecutive quarter, which is at least the worst performance since 1980, which is not a good omen for the dollar outlook," said Hans Redeker, head of strategy at Morgan Stanley.

It is worth noting that since the non-agricultural data last Friday, the market's expectations for the Fed to raise interest rates have declined. According to CME's Fedwatch, investors are expecting a cooling of the Fed's December 2016 rate hike. Currently, the market expects the Fed to raise interest rates by 25% in September.

Steven Saywell, head of foreign exchange strategy at BNP Paribas, told Bloomberg: "The market is lowering expectations for a rate hike by the Fed. After the release of US non-agricultural data on Friday, the market raised its expectations for a rate hike by the Fed, but then the probability is stable. decline."

Therefore, the expected cooling of the Fed’s interest rate hike is widely believed to be the reason for the fall in the US dollar. However, the Mitsubishi UFJ bank has different views in today's report.

Derek Halpenny, Director of Europe for Mitsubishi Tokyo UFJ Bank, pointed out in the report that the current market does not seem to have a clear main line to drive the foreign exchange market, but the dollar continues to be under pressure, there are many reasons behind it:

1) The most common explanation is that the market is expected to cool the Fed’s interest rate hike. The US short-term interest rate retraced last weekend, but the fluctuations are small, and it seems that it has not fully matched the decline of the dollar.

2) Monetary policy expectations and short-term spreads. Such as AUD/USD, NZD/USD and USD/CAD, these commodity currencies are far stronger than the US dollar, as the market is concerned about changes in monetary policy expectations and short-term spreads.

3) Position adjustment. The decline in the dollar may only reflect the long-term profit of the dollar bulls in the relatively light market conditions, the speculative market is still doing more dollars, the US presidential election may be noticed, and the market will return to normal trading in September. Market participants currently hold lighter positions.

In conclusion, it is clear that there is no single clear main line to explain the extent of the dollar's decline, which makes us suspect that this is only due to the summer market. This week, many traders and investors are still in the summer vacation, and trading will be quite dull.

As the dollar has gone down the whole line, non-US currencies such as the euro, the yen, and the pound have "take the opportunity"! The euro/dollar rose to a one-week high of 1.1190; the dollar/yen fell below 110, hitting a low of 100.95 since August 5; the pound/dollar finally recovered and hit a high of 1.3090 in the day...

(Pound Sterling / US Dollar 60 Minutes Source: FX168 Financial Network)

As the Bank of England's last eagle "rebellion", coupled with the British economy's frequent news, the pound / dollar fell sharply on the last trading day, fell below the 1.30 mark, the lowest once hit a month low.

"The core theme of the pound has not changed: the authorities are happy to see the British pound exchange rate is lower, so the pound may go lower. But currently it is mainly affected by the relative strength and weakness of the dollar every day," said Simon Derrick, head of global market research at Mellon Bank in New York. .

The Bank of England plans to buy more than £1 billion in long-term debt on Tuesday, but the final supply is a short-term target of 52 million pounds ($68 million), indicating that one of its latest economic stimulus measures has gone wrong.

This is the first time the Bank of England has failed to find enough bond sellers to reach the target of debt purchase since it began to purchase government bonds in 2009 to revitalize the economy, which in turn led to record lows in UK bond yields.

The GBP/USD is only a rebound in the “East Wind†style, and investment bank analysts are still bearish on the market outlook.

David Bloom, global head of currency strategy at HSBC, said the weakness of the pound will continue into 2017, while the Bank of England will further increase its easing, cut interest rates to 0.10% in November and expand QE in February next year. The pound exchange rate will be in line with the euro in November this year. At the end of 2017, the pound may fall to 1.10 against the dollar. Soros, who successfully made a bet on the short-selling pound in 1992, predicted that the pound would fall below 1.15 against the dollar after leaving the European Union.

James Nelligan, currency analyst at Royal Bank of Scotland (RBS), said RBS expects a EUR/GBP medium-term target of 0.80 and GBP/USD to 1.45; however, it is expected to retest the recent lows before the pound rebounds, with a target of 1.20. It is expected that in the fall decision statement, the Bank of England may introduce a more relaxed fiscal policy or further cut interest rates by 5-10 basis points.

BNP Paribas recently wrote that we still maintain the view that we are all bearish on the pound and believe that the short-term target of GBP/USD is pointing at 1.24. The Bank's STEER model also gives advice on shorting GBP/USD.

Due to the weakening of the US dollar, the precious metal market broke out: spot gold continued to climb, hitting a high of $1357.17 per ounce in three days since the day; spot silver hit a high of $20.49 per ounce since four trading days; Platinum broke through more than 6% during the Asian session, and refreshed the high of 745.75 US dollars per ounce on June 11, 2015, and rose more than 32% during the year; palladium once rose 7.6% to 746.38 US dollars / ounce, 2015 It reached its highest level in June and rose by about 30% during the year.

(Spot gold 60 minutes map source: FX168 financial network)

Bran Lum, an analyst at Phillip Futures Pte in Singapore, said in an email: "Although non-agricultural data is pushing up the dollar, the market is cautious about whether the Fed can raise interest rates in September. Given the long-term prospects, Clearly, market participants may continue to buy gold.†Lum said investors will pay close attention to the US July retail sales and initial jobless claims data released later this week. Unless the data is strong, the price of gold remains stable above 1330.

Shandong Gold 600547, chief analyst of the stock bar group Jiang Shu said, "The current market is a bit messy, there is no trend. With the fall of the dollar, we see gold and silver prices are rising. However, although the price of gold will rebound in the short term, but believe not Will last forever."

Jiang Shu expects that gold prices will be traded at $1330-1350 per ounce as there are not many new economic indicators announced this week.

Reuters technology analyst Wang Tao pointed out that as the price of gold broke through the resistance of $1,346, the short-term gold price may rise to $1,354.

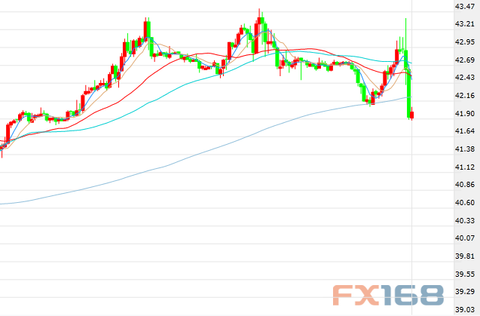

In the US market in early trading, US oil fell below the US$42/barrel mark to the low of US$41.82/barrel, and the decline expanded to 2%. The oil oil fell to the US$44/barrel mark.

(US oil 60 minutes map source: FX168 financial network)

Data released by the US Energy Information Association (EIA) on Wednesday showed that US crude oil inventories increased last week, but gasoline and refined oil inventories fell. After the release of EIA inventory data, the long and short fierce game oil prices jumped up and down.

EIA announced that US crude oil inventories increased by 1.055 million barrels last week to 523.6 million barrels, and the market is expected to decrease by 1.025 million barrels for the third consecutive week. Cushing's stock of US crude oil delivery increased by 1.16 million barrels to 65.26 million barrels, the largest increase since the week of May 6.

(Source: Zerohede, FX168 Financial Network)

EIA data also showed that US gasoline stocks fell by 28.07 million barrels last week to 235.38 million barrels, and the market is forecast to reduce 10.63 million barrels. US refined oil stocks decreased by 1.959 million barrels to 151.2 million barrels, the market is forecast to increase by 513,000 barrels, and refined oil stocks fell the most since the week of May 13.

According to reports, after the release of EIA data, NYMEX's most active September WTI crude oil futures contract on August 10, 22:39-41, within 26 minutes, 26,668 lots, worth more than 1.1 billion US dollars, a huge amount of trading into the game, so that the US oil wide The fluctuation is nearly 2%.

Well-known financial Zeroohedge commented that EIA data for the week said that following the unexpected increase in API crude oil stocks announced on Wednesday morning, the EIA inventory released in the evening also recorded an increase, which made the market different. The increase in crude oil inventories in Cushing reached the maximum in three months. Refined oil inventories also recorded an increase; on the other hand, gasoline inventories fell sharply far beyond expectations. US domestic production fell, and long-short factors played a game, causing international oil prices to rise first and then fall wide and fluctuate.

Bloomberg commented that the EIA data on Wednesday night showed that the demand for crude oil in the refinery is declining, so crude oil inventories have risen; the refinery's move is also a last resort, because the level of gasoline and refined oil stocks are already too high, increasing production and It is meaningless; in addition, it will enter seasonal maintenance immediately, and the refinery's purchasing power for crude oil will further decline, and the oil price outlook is still bleak.

In addition, OPEC pointed out in the monthly report that according to Saudi Arabia's report on OPEC, Saudi crude oil production in July reached 10.67 million barrels per day, a record high. This news also put pressure on oil prices.

OPEC pointed out in the monthly report that the daily output of crude oil in OPEC member countries increased by 46,000 barrels to 33.11 million barrels in July. However, OPEC expects that crude oil consumption will increase in the coming months, helping to alleviate the problem of oversupply and will help the oil market to rebalance.

According to the monthly report, global oil demand in 2016 is expected to rise by 1.22 million barrels, an increase of 30,000 barrels per day from the previous month. It is expected that the global crude oil supply will exceed 100,000 barrels per day in 2017.

Adam Longson, head of commodities research at Morgan Stanley, said in an interview on Tuesday (August 9) that the crude oil market will still face a series of bearish factors during the rest of the year, which will weigh on the lowest oil prices. Dropped to $35/barrel.

Longson said, "I don't think the oil market has completely shaken off the shadows. The rise in oil prices at the beginning of this summer may be just a correction to the previous decline, which makes us even more pessimistic."

He also pointed out that oil prices may have initial support in the middle of the $30/barrel level, as the Organization of Petroleum Exporting Countries (OPEC) may start discussions and the market will have some short covering. However, Longson expects the average price of crude oil in the fourth quarter of this year is expected to be 40 dollars per barrel.

Longson explained, “At the moment, not only is the crude oil market oversupply, but a bigger challenge is the oversupply in the gasoline market. I believe there are still some problems to be solved before the oil market finally has a real recovery.â€

(Editor: Li Xingwang HF015)A must-have product for the home, our eye masks guarantee a comfortable night's sleep. They are made of silk, cotton, knitting and other materials.

Not only is the shading effect good, the eye mask also has a very good touch.

It is our best choice. In addition, there are a variety of colors to choose from. It is compact and suitable for travel and can be used during lunch breaks in the office.

Homemade Blindfold,Fashion Blindfold,Fashion Eyeshade,Silk Blindfold

Yangzhou Youju E-commerce Co.,Ltd , https://www.yzxygarment.com